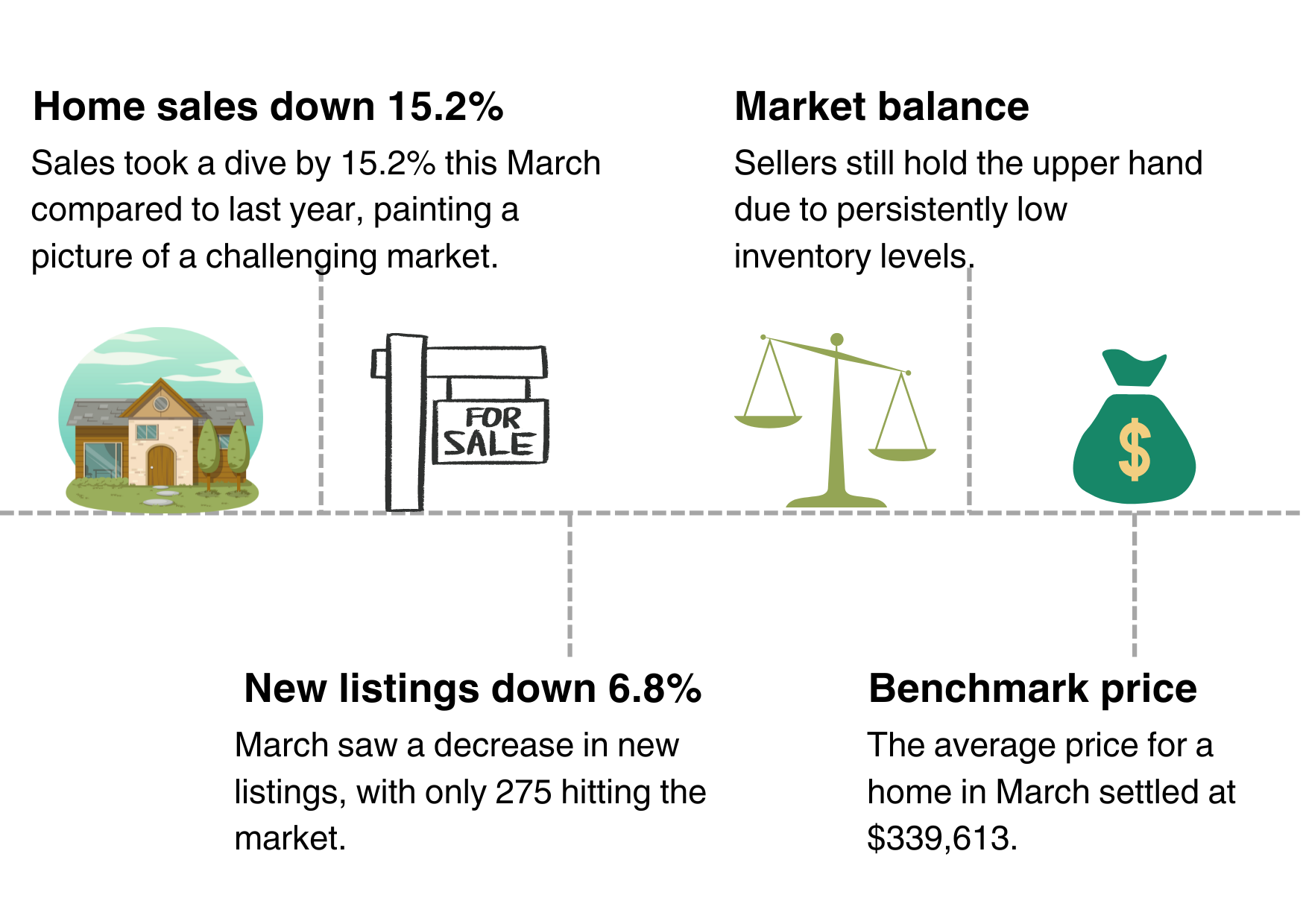

I’m here with your latest real estate update. Sales took a dive by 15.2% this March compared to last year, painting a picture of a challenging market. Despite this drop, sellers still hold the upper hand due to persistently low inventory levels.

March saw a decrease in new listings, with only 275 hitting the market, marking a 6.8% decline from March 2023. The average price for a home in March settled at $339,613, with the median price nearly mirroring this at $335,000.

Zooming out to the broader scope of the first quarter, the trend continues downward. Total sales from January to March fell by 4.9% to 371, while new listings dipped by 2.1% to 616. The average price for the first three months clocked in at $322,302, with the median price closely trailing at $319,900.

Bidding wars have become a common occurrence in this competitive landscape as buyers grapple with limited options in the seller’s domain.

However, amidst the uncertainty, there is a glimmer of hope. The Bank of Canada has refrained from hiking its key overnight interest rate since July 2023, offering potential relief for mortgage holders. Speculation looms as the central bank eyes possible rate cuts later this year, contingent upon economic and inflationary trajectories aligning with their forecasts. It’s a waiting game, but there may be light at the end of the tunnel for those navigating the mortgage market. Stay tuned for further developments.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link